SEIFSA Price and Index Pages Report – September 2022

The aim of this report is to analyse fuel costs and the exchange rate relating to the period January – August 2022.

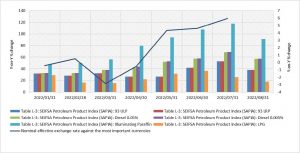

Fuel Costs and Nominal Exchange rate

The surge in Brent Crude Oil prices against the backdrop of the Russia and Ukraine situation has had negative spill-over effects on the global and domestic economy, particularly resulting in all time high fuel price increases, higher inflation as witnessed by the consumer price inflationary trend and spiking interest rates, thus having a direct knock-on effect on consumers, businesses and wider economy.

With the South African economy being an industrial economy whereby most businesses are reliant on diesel, for the period of January – August 2022, the cost of diesel 0.05% and diesel 0.005% rose by 42.2 percent and 42.5 percent respectively. The rising diesel cost creates more burden on businesses particularly in the metals and engineering, construction, logistics and manufacturing sector. The effect can also be noted in the decline of the purchasing managers index dropping to 47.6 index points in July 2022 (below the 50-index benchmark) and the consecutive decline in the manufacturing production figures (from April – June 2022 on a year-on-year basis)

The South African fuel price is determined by the Rand-US dollar exchange and the international oil prices, between January 2022 and July 2022, the Rand exhibited a depreciating trend (based on year-on-year % changes) against the US dollar. On average the Rand depreciated by 8.7 percent against the US dollar during this period. Some net exporting companies generally welcomed the weaker exchange rate as their exports were more competitive with major trading partners, while this was not the case for net importers. Despite increased export competitiveness, the weaker exchange rate also contributed to higher imported input costs for domestic producers.

Though there are pockets of green shoots in the economy, the path to recovery remains heavily constrained by the weaking Rand coupled by rising fuel costs, unstable electricity supply, high inflationary pressures, low growth rates and high unemployment rates as a result of domestic and external factors.

Thus, it is crucial for policy-makers to address the issue of rising fuel costs and develop long-term strategies to remedy high inflationary pressures and ensure that the South African railway system becomes viable and efficient.

Palesa Molise

Economist | SEIFSA

SEIFSA Economics Unit