SEIFSA Price and Index Pages Report – September 2022

SEIFSA Price and Index Pages Report – September 2022

The aim of this report is to analyse fuel costs and the exchange rate relating to the period January - August 2022.

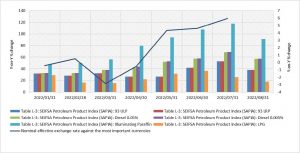

Fuel Costs and Nominal Exchange rate

The surge in Brent Crude Oil prices against the backdrop of the Russia and Ukraine situation has had negative spill-over effects on the global and domestic economy, particularly resulting in all time high fuel price increases, higher inflation as witnessed by the consumer price inflationary trend and spiking interest rates, thus having a direct knock-on effect on consumers, businesses and wider economy.

With the South African economy being an industrial economy whereby most businesses are reliant on diesel, for the period of January – August 2022, the cost of diesel 0.05% and diesel 0.005% rose by 42.2 percent and 42.5 percent respectively. The rising diesel cost creates more burden on businesses particularly in the metals and engineering, construction, logistics and manufacturing sector. The effect can also be noted in the decline of the purchasing managers index dropping to 47.6 index points in July 2022 (below the 50-index benchmark) and the consecutive decline in the manufacturing production figures (from April – June 2022 on a year-on-year basis)

The South African fuel price is determined by the Rand-US dollar exchange and the international oil prices, between January 2022 and July 2022, the Rand exhibited a depreciating trend (based on year-on-year % changes) against the US dollar. On average the Rand depreciated by 8.7 percent against the US dollar during this period. Some net exporting companies generally welcomed the weaker exchange rate as their exports were more competitive with major trading partners, while this was not the case for net importers. Despite increased export competitiveness, the weaker exchange rate also contributed to higher imported input costs for domestic producers.

Though there are pockets of green shoots in the economy, the path to recovery remains heavily constrained by the weaking Rand coupled by rising fuel costs, unstable electricity supply, high inflationary pressures, low growth rates and high unemployment rates as a result of domestic and external factors.

Thus, it is crucial for policy-makers to address the issue of rising fuel costs and develop long-term strategies to remedy high inflationary pressures and ensure that the South African railway system becomes viable and efficient.

Palesa Molise

Economist | SEIFSA

SEIFSA Economics Unit

SEIFSA Price and Index Pages Report – August 2022

SEIFSA Price and Index Pages Report – August 2022

The aim of this report is to highlight the significant contributors to price movements from the exchange rate analysis and also from both an input cost and final selling price analysis in the metals and engineering sector relating to June 2022.

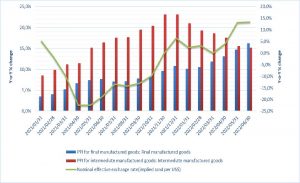

Producer Price Index (PPI) and Nominal Exchange Rate

Generally, PPI for final and intermediate manufactured goods would follow a similar trend as intermediate products filter through to the production and assembly of final manufactured goods. Between January 2021 and June 2022, the PPI for intermediate manufactured goods was higher than that of final manufactured goods due to higher input costs and a weaker Rand.

From the below graph PPI for intermediate manufactured goods started following a disinflationary trend on a year-on-year from a high 23.1 percent to a low 15.2 percent, indicating a slowing pace of selling price inflation during the period December 2021 – June 2022. Whilst final manufactured goods took a stronger upward trend, amid a period of uncertainty, persistently high inflation brought about by the Russia-Ukraine war, generally weaker exchange rate and slower economic growth. This reflects a 6th consecutive year-on-year disinflationary pressure in the PPI for intermediate manufactured goods, which is indicative of prolonged subdued domestic demand. It is worth noting that the disinflationary pressure does not augur well for producers especially in an economy stuck in low growth and rising input costs, leaving no leeway for manufacturers to pass on cost increases into the market.

With producer inflation moving in the same direction as consumer price inflation (CPI), headline inflation has risen sharply thus, having a direct response to the depreciation of the rand, which then directly raises the prices of imported goods in the domestic economy, and subsequently results in a negative implication on firms who are reliant on imports. The graph below depicts the sharp depreciation of the rand per Us dollar during the period of April – June 2022. The response of a weaker rand is also seen in the negative trade balance of -R112.2 billion recorded in the metals and engineering (M&E) sector during the period of January – June 2022.

Within the M&E sector, the gloomy slow economic growth and high inflation is also reflected by the poor performance in the manufacturing production data, steep increases in precious metals as well as in declining purchasing managers index PMI levels (which measures the industrial activity) declining to 47.6 index points in July from 52.2 in June 2022.

The disinflationary trend in the intermediate producer price index augments significant burden to manufactures in the metals and engineering (M&E) cluster of industries and is worrisome as further disinflationary pressures persist in the selling prices coupled with increasing operational costs will burden margins.

Disconcertingly, the energy crisis in the country resulting in increasing energy costs remain a significant challenge to energy-intensive metals and engineering industries posing major challenges to policy makers as the highlighted constraints may lead to further slowdown in growth, employment and gross fixed capital formation.

However, we remain hopeful that the new power generation projects underway will bolster the country’s grid and incease production levels.

SEIFSA Price and Index Pages Report – June 2022

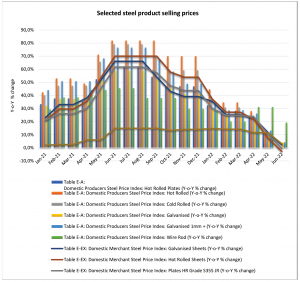

This Price Report provides an analysis and insights to selected domestic steel producer and merchant selling prices. This report involves an analysis of selling prices of various products between January 2021 and June 2022.

Figure 1 below captures the monthly general movements in the selling prices of seven selected steel material products over an 18-month period between January 2021 and June 2022. The Domestic producer selling prices of selected steel variables analysed are (Hot rolled plates, Hot Rolled, Cold Rolled, Galvanised, Galvanised 1mm+, Wire rod) and; Domestic Merchant selling prices (Galvanised sheets, Hot Rolled Sheets, Plates HR Grade S355 JR).

For the review period, there has been a general increase in steel prices across all variables with highest increases from 16.9 percent year-on-year in June 2021 to 81.9 percent year-on-year in September 2021. These high increases were mainly as a result of steel shortages on the back of a faster resumption of demand as the economy opened up, and supply chain challenges against the backdrop of COVID-19. From January 2022, both domestic Producer and Merchant prices have been on a stabilised.

The stabilising trend is a welcomed development for the downstream users of steel. This will contribute to steel and engineering sectors recovery and enables businesses to leverage off less aggressive steel price increases, improving on their production and profit margins in the current challenging operating environment of high inflationary pressures, volatile exchange rate, COVID-19 and the Russia and Ukraine invasion. There are however some cost push inflationary risks to steel prices emanating from the Russia/Ukraine conflict. There have been substantial increases in the steel input cost basket (coal, zinc, nickel and electricity) which presents this upside risks to domestic prices.

Figure 1: Selected steel selling prices

Palesa Molise Economist | SEIFSA SEIFSA Economics Unit

SIX (6) INTERESTING FACTS YOU MAY NOT KNOW ABOUT CONTRACTS

SIX (6) INTERESTING FACTS YOU MAY NOT KNOW ABOUT CONTRACTS

Irrespective of whether you are running a small business or a large enterprise, contracts will become an integral part of your operating environment. This is especially true given that you will have some form of a contractual commitment relating to the purchase or supply of goods and services as part of the day-to-day activities in your business. Therefore, it is very important for you to implement and manage contracts effectively.

A contract ensures that the interests of both parties are legally protected, while also ensuring that the parties to the contract fulfil their obligations as agreed to.

Once a contract has been signed, it may be very difficult – and even impossible – to get out of without such action having an adverse financial impact on your business. To ensure that the outcome of a contract is fair to both the buyer and supplier, there are a number of aspects pertaining to contracts that one has to be cognisant of and be familiar with. These include the following:

1. It is better to have contractual agreements in writing

While contracts can be verbal or written, it is advisable to have all agreements in writing. Verbal contracts are often difficult to prove and may lead to additional disputes when misunderstandings occur. Moreover, because verbal contracts are difficult to prove, they may put a strain on the business relationship of the parties to the contract and may also lead to project cost overruns when parties cannot agree to the terms and conditions. These types of disputes can be avoided by ensuring that all the terms and conditions are written and agreed to by both parties.

2. Understand the essential elements to a contract

a. Capacity

It is important that the parties to a contract understand the terms and conditions set out by the contract, and that consent to the contract must be given out of free will and must not be forced or influenced.

b. Offer and Acceptance

The agreement will be in force when an offer is made by one party, which is subsequently accepted by the other party to the contract.

c. Certainty

Contracts must avoid vague terminology and should have definite terms, especially given that a court will not uphold contracts that are vague.

d. Possible

The contractual obligations must be possible to carry out.

e. Lawful

If a contract is against public policy or unlawful, the contract will not be legally valid.

3. General terms and structure of an agreement

There is no standard format that a contract must adhere to. The contract will generally include various terms and conditions that will form the basis of the contract. If contract conditions are not met, the contract may be terminated. Moreover, there are different aspects and unique characteristics that are relevant to each contract that one has to consider in drawing up the contract.

4. You do not have to sign the agreement if you don’t understand it

It is important to ensure that both parties to the contract understand the terms and conditions as set out, especially given that the contract is legally binding. If you find yourself in a situation where you are not quite sure what the terms and conditions mean, do not sign and hope for the best. Rather, make sure you get someone to assist you before you sign. This is a very important point, especially if your company is new to the tender and contract space and if you are concerned that you will lose out on a contract being awarded if you do not agree to the terms and conditions that were stipulated at the onset.

5. Contracts and their contents are negotiable

Contracts contain a lot of details, but it does not mean that everything is set in stone. The terms and conditions of a contract are negotiable (like the period of the escalation or the size of the fixed portion, etc.). If you do not agree to the terms that are being offered, make a counter offer. For example, if the contract stipulates that a fixed portion of 15 percent should be included in the cost breakdown, you are well within your rights to negotiate a smaller fixed portion.

6. You need to adjust contracts regularly to ensure that margins and profits are maintained and maximised

More often than not, Contract Price Adjustment-linked (CPA-linked) contracts are escalated on an annual basis. That is because companies (both buyers and suppliers to the contract) regularly cite labour constraints and the administration that is linked to CPAs as reasons for doing escalations annually. Often times, there is a limited number of employees in a company who are responsible for tendering and contract escalations. If an individual oversees a large number of contracts, there may not be sufficient time to complete normal day-to-day work activities and also do more frequent escalations.

Apart from the work involved in a tender process and contract escalations, parties to a contract generally do not have an understanding of the implications of frequent escalations (e.g. monthly) compared to non-frequent escalations (e.g. annually) on contracts. Generally, input costs change monthly, although there are certain inputs that change on an annual basis, such as labour costs.

We often receive queries where a supplying company states that the price of some of its input cost components has increased significantly in recent months and that the buying company does not want to accept an escalation to recover the costs. The first point of reference is to refer back to the contract and to determine what was stipulated and agreed upon by both parties. If the contract stipulates that all escalations must be done annually, and if the annual escalation is not currently due, the supplying company will not be able to pass such increases on to the buying company. This will invariably impact negatively on the margins of the supplying company.

Let’s make use of an example to expand further:

For the purpose of this example, we assume that you run a construction company and that you have entered into a two-year contract with a buying company for the building of an office park, and that the parties agreed to an annual escalation. The input cost components may include labour, materials comprising reinforcing steel, cement, bricks, roofing, etc., as well as transport.

It is important to highlight that the prices of the majority of the input cost components in your company’s cost breakdown (excluding labour) will change (increase or decrease) on a frequent (i.e. monthly) basis.

In the process of building the office park, your company will incur costs on a frequent basis through the purchase of various materials used in the construction process. Moreover, the price of the items purchased might differ from one purchase to the next as a result of changing input costs that the manufacturer passes on to its buyers – in this case, your company.

While the price of your inputs will change as a result of changes in the price of the inputs of the manufacturer from whom you bought the products, you will not be able to do an escalation and pass the change in the price onto the buying company. This is because you entered into a contract for the building of an office park where escalations are done on an annual basis, and the annual escalation may not be due yet. This will invariably eat into your margins and profits, in the process impacting on the sustainability of your company, especially given that your company will need to have sufficient cash flow available to continue with the project and to absorb various price increases.

Had you entered into a contract where more frequent escalations were agreed upon, the situation would have been different as you would have been able to pass changes in the price of the inputs used in the construction process on to the buyer on a more regular basis, ensuring the sustainability of your company. Therefore, it is crucial to adjust contracts regularly to ensure that margins and profits are maintained and maximised.

Contract Management is a crucial part of a business and can account for significant leakages in finances and can also have a long-term impact.

SEIFSA can help, both with your Contract Price Adjustment and the drafting or reviewing of your contract or Service Level Agreement, through our Economic and Commercial Division and our Industrial Relations and Legal Services Division.

Ends

SEIFSA PIPS: A FUN FACTS GUIDE

The SEIFSA Price and Index Pages (PIPS), a Steel and Engineering Industries Federation of Southern Africa publication, has reached its 60th successful year of production. Subscriptions to PIPS have more than doubled since 2010 from 800 to more than1200 companies.

An estimated readership of 16 000 comprises mainly of buyers and contract procurement managers of most large companies in the transport, construction and manufacturing industries, as well as government and large parastals such as Eskom, Transnet and the water boards.

PIPS consists of more than 200 independent market- or product-specific indices that SEIFSA reviews and updates on a monthly basis. These indices are widely used to determine and negotiate Contract Price Adjustments to ensure a fair and equitable deal for both client and supplier.

In fact, Eskom insists that all of their suppliers use SEIFSA PIPS in their cost escalation exercises.

THE INDICES: OUR CATEGORIES

- Labour Indices

- Consumer Price Index

- Steel Indices

- Metal Indices

- Construction Material Indices

- Distribution and Power Transformers

- Road Freight Indices

- Petroleum Products

- Production Price Indices

- Electrical Cable Manufacturing Materials

- Stainless Steel Indices

- Aluminium Indices

- Chemical Indices

- Commodities

- Export and Import Price Indices

- Interest Rates

- International Production Prices Indices

- Exchange Rates

THE MISSION OF SEIFSA’S ECONOMICS AND COMMERCIAL DIVISION

It is the mission of SEIFSA’s Economics and Commercial Division to give voice to and raise the profile of the metals and engineering sector in the national discourse on economic, industrial and trade policies. The Economics and Commercial Division also produces its PIPS product and hosts training workshops in which the Division highlights the essence of the indices and the importance of Contract Price Adjustments.

The metals and engineering sector is a strategic industry for South Africa, comprising 45% of manufacturing and contributing 6% to the gross domestic product of the country. Real output in the manufacturing sector accelerated to 4.3% in the third quarter of 2017, following an increase of 1.5% in the second quarter, as activity in manufacturing expanded at a faster pace, contributing 0.5 percentage points to overall GDP growth. The companies in the sector export 52.1% of their production to the rest of the world, earning valuable foreign currency for South Africa.

The health of the industry is vitally important.

The SEIFSA Economics and Commercial Division accomplishes its mission through:

- Research of economic and cost trends;

- Communicating sector market intelligence to its members, associates and the general public;

- Monitoring the international and domestic economic and policy environment;

- Supporting companies in the sector to make more informed business decisions;

- Having a particular focus on small and medium size businesses; and

- Offering a comprehensive advisory service on black economic empowerment and assisting companies to achieve this business imperative.

SEIFSA INFLUENCE

The Economic and Commercial Division strives to influence the business environment positively by representing the sector in debates and forums about monetary, fiscal, industrial and trade policies.

This is done through:

- Direct interaction with the relevant institutions in the public sector, like the South African Reserve Bank, the National Treasury, the Department of Trade and Industry, Customs, the National Empowerment Fund and many similar organisations or institutions.

- It is also done through participation in multilateral forums through Business Unity South Africa and the National Development and Labour Council.

Particular ad hoc research is done from time to time on subjects like the electricity crisis, or the extent and impact of import penetration into the metals and engineering market. In many instances, the very rich knowledge present amongst individuals, or within associations or sub-industries is harnessed and utilised in compiling position papers on issues of importance to the sector.

An example of our market commentary can be seen in our press releases like the one issued on 28 February 2018, which highlighted the impact of the Producer Price Index (PPI) data released by StatsSA.

The Stats SA data showed that the PPI for intermediate manufactured goods decreased to 1.5 percent year on year in January 2018, from the 3.2 percent recorded in December 2017.

“This is a poor performance, especially given the four consecutive months of PPI increases for intermediate manufactured goods prior to December 2017,” SEIFSA Economist Marique Kruger said.

Also, given the volatility of input costs in the sector, the deceleration in the PPI data leaves manufacturers with little leeway to pass cost increases on to the market. Correspondingly, SEIFSA’s composite input cost index, which tracks the average cost structure for the M&E sector, was recorded at 1.4 percent in January 2018, up from 3.4 percent in December 2017.

Ms Kruger said it is important to maintain a positive differential in the selling price inflation and input cost inflation in order for the sector to stay attractive for existing and new investments.

“Hopefully, the PPI for intermediate manufactured goods will rebound against the backdrop of a continued improvement in business confidence, especially in light of recent developments in South Africa’s political landscape,” Ms Kruger said.

This analysis on PPI Provides insights into SEIFSA’s Economic and Commercial Division and demonstrates its capacity and wide-ranging media influence.

What is cost price adjustment and why is it so important

Based on the terms and conditions set out in the tender awarded to you, it is now time for you to take stock of what has happened to the price of the product or service you provided over the last couple of months/year. You also need to supply the information to the buying party to your contract. So where to from here?

Unfortunately, you cannot go to the buyer and tell them that your costs have increased by 11% and expect them to pay it, especially if you do not have proof. Without substantial proof to support the increase in the costs you want to pass onto the buyer, your request will not be met. So how do you get the proof? Easy, through calculations in a Cost Price Adjustment (CPA) with the use of relevant industry related price indices which will give you a true and accurate reflection of what has happened in the market.

Alright, so you know you must do a CPA but you have no idea what it is, let alone how to apply it or why it is beneficial to you. The aim of this blog is to do just that – give you a better understanding of what a contract price adjustment is.

In the simplest terms, a CPA is a process in which you calculate the extent to which the price of inputs of the product or service you supply, has increased or decreased over a specified period of time. This means that due to unforeseen circumstances (i.e. inflation) the cost of doing business has changed and you have to account for it in some way because it ultimately impacts on the price of the contract over the duration thereof.

Both parties to the contract aim to sustain or improve the profitability of their business. Buyers therefore try to manage and maintain their costs, while suppliers want to recover as much cost as possible.

Let me explain the importance of a cost price adjustment with the use of an example:

You are a supplier to a contract. The initial contract value was R10 000 000, the contract term was for 10 years and you were allowed to escalate (do your cost price adjustment) once a year. At the end of the 10-year period the contract value that you calculate by taking costs into account amounted to R14 233 118. One of your colleagues came to you and mentioned that you made an error in your calculations and that the contract value was actually supposed to be R16 894 790. Through discussions with your colleague you actually realise that you applied the calculations incorrectly because you didn’t understand the contract price adjustment process. As a result, your company lost R2 661 671 on the contract. What is worse is that the profit calculated at the start of the contract was R2 000 000 which means that your company actually has to pay in, in order to finalise the project (thereby putting your company in a worse position).

This example can be explained from the buyer’s side as well. Let’s assume the same contract over the same period as in the above example. At the end of the 10-year span the contract cost you R16 894 790. Your colleague then tells you that the cost of the contract was supposed to be R14 233 118. Unfortunately, your company overpaid by R2 661 671 because you didn’t understand the process and applied calculations incorrectly.

As the company supplying the product or service, you are therefore assured that you can justify the cost increase you are passing on to the buyer and that the costs were accurately calculated from your CPA which is based on what has happened in the market. The correct application of the CPA also allows the company buying the product or service to be certain that market related increases are paid out, ensuring the sustainability or improvement of business profitability.

In order to accurately calculate your costs, you need to make use of SEIFSA’s price indices and apply them to the mathematical formula which is based on the inputs of your product or service. Although the mathematical formula is a very important aspect to your CPA, it will be of no benefit if you do not use the correct price indices. The use of the incorrect indices could have an adverse effect on the increase you calculate. Often times the CPA process is handed to staff in financial positions due to the calculations involved. However, it is very important that the technical people in the company assist with the process, especially when tendering. This is because the technical people have a better understanding of what inputs are used in the manufacturing of a product. If for example your company manufactures power transformers, the technical person would know that one of the materials used is electrical steel.

SEIFSA’s Price and Index Pages (PIPS) currently offer a wide variety of steel indices and because you lack the technical knowledge you might link the incorrect steel index to the material component.

If you are worried about changes in the input costs in your tender application or the right time to escalate (that is, make adjustments to your contract), subscribe to SEIFSA’s Price and Index Pages and join a CPA workshop to better understand the process involved.

What are the SEIFSA Indices?

So, you are in the process of tendering for that big contract and it is a requirement that you make use of the SEIFSA indices to assist you in accurately pricing your tender contract. At this point in the tendering process you might not be aware of who SEIFSA is or that SEIFSA even has price indices available. At the same time, you might not have a clear understanding of what an index is, or what the purpose of using an index is, let alone have knowledge of a SEIFSA price index.

The aim of this blog is to give you as a tenderer a basic understanding of indices and to give you an overview of the SEIFSA indices on offer. Lastly, we aim to give you a brief explanation as to why you should use the SEIFSA price indices in the tendering processes and subsequent escalations.

In the most basic sense you use an index as a statistical measure of changes in two or more data points. What I mean here is that one index point (e.g. 102) tells you nothing. In order for indices to have meaning, you need to have at least two index points to calculate the percentage increase or decrease between any two periods. Just by looking at the indices you should already have an indication whether the price of what you are interested in (e.g. domestic merchant steel) increased or decreased between two periods.

Let me show you with an example:

The table above is a hypothetical example giving index points which reflect domestic merchant steel prices for the months of January 2017 and February 2017. Without doing any calculations you can see that there was an increase in domestic merchant steel prices. How? The index value in February 2017 is higher than that of January 2017. Now that you know that the price of domestic merchant steel increased between these two months, you can easily calculate by how much. You can make use of either of the following formulas to calculate the percentage change in the price of domestic merchant steel:

- ((New/Old) – 1) *100

- (New-Old/Old) *100

Both of the above formulas will give the same results. Based on both formulas and the figures cited in the example, the change in the price will be 2%. There are some advantages to using indices.

Firstly, an index hides sensitive information such as the source of the information or the actual price level and secondly, it minimises errors in computation that are often associated with larger numbers. It is much easier to type 125.1 as opposed to 138 789, which allows for reduced errors. It is also important to understand that a price index only indicates the extent to which the price of an item has changed when compared to some earlier point it time. Moreover, a price index does not give you an indication of the actual level of the variable which means that you won’t know what the exact price of the item (i.e. domestic merchant steel) is. Important to understand is that when the domestic merchant steel price increases by 10% in a given month, that 10% increase will be reflected in the index for that same month.

Now that you have some background on indices, allow me to go into a little bit more detail regarding the SEIFSA indices. Every month SEIFSA updates and publish over 200 price indices in the SEIFSA Price and Index Pages (PIPS). We have time series for some of these price indices dating as far back as the 1960s.

SEIFSA PIPS cover a wide spectrum of price indices which includes but is not limited to labour, transport, overheads and materials. The SEIFSA labour indices cover all 13 job gradings as set out by the Metal and Engineering Industries Bargaining Council (MEIBC). Although our labour indices relate mostly to the Metals and Engineering sector, we also publish labour indices for other industrial sectors.

In addition to indices for petroleum products, we publish two road freight (transport) indices that you will apply based on your primary activity of business. For overheads, SEIFSA PIPS offer you indices for both office and production. We also have indices that you could apply if you have an imported component in your cost breakdown. These include exchange rates and imported unit value indices (UVI).

SEIFSA PIPS offer a wide array of indices relating to materials. In terms of steel, our offering includes but is not limited to domestic merchant and producer price and stainless-steel indices. A number of material indices relevant to different type of engineering activities are also available along with commodity indices.

When you make use of PIPS in your tender submission you can be assured that your tender bid is comprehensive and competitive because you will be able to accurately calculate the changes in inputs that affect the final cost of manufacturing. SEIFSA PIPS is the best tool to use to use for contract price adjustment as well.

How the tender processes in South Africa works

Tender processes in South Africa need careful and accurate preparation to help you land that big tender but it can also be a time-consuming and costly exercise, especially if you do not understand the tender bidding process or adhere to the necessary requirements (i.e. submitting all the tender forms). When an organisation such as a private company or government need to obtain specific goods or skills, they will issue a tender bid, an invitation to tender or a Request for Quotations (RFQ). The reason why a RFQ or tender invitation is advertised is to make the process fair and to promote competition by offering an equal opportunity to as many suppliers as possible to submit their tenders.

You will be able to find information on available private company tender bids through adverts in newspapers and in trade and professional magazines. Networking can also be a great way to get information on available tenders. Major national and provincial tenders are normally advertised in the Government bulletin, newspapers, notice boards at various governmental departments, post offices and police stations. Each tender bid will supply information on the following that is important to take into account:

- The RFQ or tender number;

- A short description on the requirements and eligibility criteria

- Closing date, time and address to deliver your tender submission documents. The responsibility lies with you as the tenderer to ensure that your tender bid is received at the required address in good time; and

- The compulsory meetings or and special conditions of the contract.

Failure to comply with points 3 and 4 above could lead to the disqualification of your bid. Even if you are aware of where to look for tenders, you have to make sure that your company is legally compliant which will allow you to take part in the tendering process.

Your business has to be registered, with a commendable banking history and you must have a good relationship with your clients and suppliers. Make sure that your company has an excellent credit record by ensuring that you are registered with the South African Revenue Service (SARS), all bills are paid on time and that you are up to date with company tax and VAT payments. Ensure that all your employees are registered with the Department of Labour in terms of Unemployment Insurance Fund (UIF) and Workmen’s compensation fund etc.

Each national or provincial tender has a number of forms that has to be included in your tender submission. These required forms were formerly referred to as tender forms but are now referred to bid documents. Bid documents for national tenders have the prefix of SBD.

Now that you have a better understanding of the legalities of bidding for a tender, you need to also understand the economic aspects to consider when pricing a tender. You need to remember that the pricing of a tender is different from the way you would normally price a product in your company.

Why? As a bidder, you need to consider all the cost associated with undertaking the project to ensure you calculated an optimum mark-up. Imagine you get allocated the tender only to find out that it is not profitable to undertake the tender.

Often times tender documents will state that you have to make use of SEIFSA’s Price and Index Pages (PIPS) (a data set that contains over 200 indices) with some of these indices dating back to the 1960s. The idea is that you link a relevant index to each of the input cost components in the breakdown of your tender application.

By including data from these indices in your tender application, you will be able to accurately calculate the changes in the costs of labour, steel, transport, just to name a few, and other inputs that affect the final cost of manufacturing in a business through the application of a Contract Price Adjustment (CPA). The results from the CPA calculations allow the tenderer to adjust prices in line with unforeseen cost increases.

Furthermore, by using PIPS during the tender processes in South Africa you can be certain that the cost increases you calculated is a true reflection of what happened in the market, thereby ensuring that you maintain and ultimately improve the profitability of your business.

Here are some useful tips to keep at the back of your mind that could potentially increase your chance of winning the tender:

- Make sure that you provide all necessary information as set out in the tender application. These include updated tax clearance certificate and shareholding certificates, amongst other requirements.

- Apply the relevant PIPS indices and always double-check the calculations of the prices in your tender application.

- Only tender for a contract that fits in with the scope of your business. There is no use in tendering for a tender to build a hospital if your company is in the catering industry.

- If you are unsure of anything, ask.

- Sign all relevant pages of your bid document as any unsigned documents may lead to the disqualification of your bid

- Aim to beat the client’s expectations through non-price solutions and sell them upfront. These can include doing the job in less time than required or using fewer resources.