SEIFSA Price and Index Pages Report – August 2022

The aim of this report is to highlight the significant contributors to price movements from the exchange rate analysis and also from both an input cost and final selling price analysis in the metals and engineering sector relating to June 2022.

Producer Price Index (PPI) and Nominal Exchange Rate

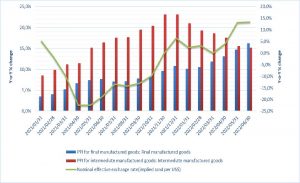

Generally, PPI for final and intermediate manufactured goods would follow a similar trend as intermediate products filter through to the production and assembly of final manufactured goods. Between January 2021 and June 2022, the PPI for intermediate manufactured goods was higher than that of final manufactured goods due to higher input costs and a weaker Rand.

From the below graph PPI for intermediate manufactured goods started following a disinflationary trend on a year-on-year from a high 23.1 percent to a low 15.2 percent, indicating a slowing pace of selling price inflation during the period December 2021 – June 2022. Whilst final manufactured goods took a stronger upward trend, amid a period of uncertainty, persistently high inflation brought about by the Russia-Ukraine war, generally weaker exchange rate and slower economic growth. This reflects a 6th consecutive year-on-year disinflationary pressure in the PPI for intermediate manufactured goods, which is indicative of prolonged subdued domestic demand. It is worth noting that the disinflationary pressure does not augur well for producers especially in an economy stuck in low growth and rising input costs, leaving no leeway for manufacturers to pass on cost increases into the market.

With producer inflation moving in the same direction as consumer price inflation (CPI), headline inflation has risen sharply thus, having a direct response to the depreciation of the rand, which then directly raises the prices of imported goods in the domestic economy, and subsequently results in a negative implication on firms who are reliant on imports. The graph below depicts the sharp depreciation of the rand per Us dollar during the period of April – June 2022. The response of a weaker rand is also seen in the negative trade balance of -R112.2 billion recorded in the metals and engineering (M&E) sector during the period of January – June 2022.

Within the M&E sector, the gloomy slow economic growth and high inflation is also reflected by the poor performance in the manufacturing production data, steep increases in precious metals as well as in declining purchasing managers index PMI levels (which measures the industrial activity) declining to 47.6 index points in July from 52.2 in June 2022.

The disinflationary trend in the intermediate producer price index augments significant burden to manufactures in the metals and engineering (M&E) cluster of industries and is worrisome as further disinflationary pressures persist in the selling prices coupled with increasing operational costs will burden margins.

Disconcertingly, the energy crisis in the country resulting in increasing energy costs remain a significant challenge to energy-intensive metals and engineering industries posing major challenges to policy makers as the highlighted constraints may lead to further slowdown in growth, employment and gross fixed capital formation.

However, we remain hopeful that the new power generation projects underway will bolster the country’s grid and incease production levels.