SEIFSA Price and Index Pages Report – June 2022

This Price Report provides an analysis and insights to selected domestic steel producer and merchant selling prices. This report involves an analysis of selling prices of various products between January 2021 and June 2022.

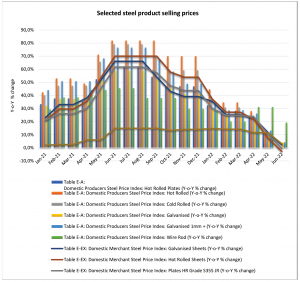

Figure 1 below captures the monthly general movements in the selling prices of seven selected steel material products over an 18-month period between January 2021 and June 2022. The Domestic producer selling prices of selected steel variables analysed are (Hot rolled plates, Hot Rolled, Cold Rolled, Galvanised, Galvanised 1mm+, Wire rod) and; Domestic Merchant selling prices (Galvanised sheets, Hot Rolled Sheets, Plates HR Grade S355 JR).

For the review period, there has been a general increase in steel prices across all variables with highest increases from 16.9 percent year-on-year in June 2021 to 81.9 percent year-on-year in September 2021. These high increases were mainly as a result of steel shortages on the back of a faster resumption of demand as the economy opened up, and supply chain challenges against the backdrop of COVID-19. From January 2022, both domestic Producer and Merchant prices have been on a stabilised.

The stabilising trend is a welcomed development for the downstream users of steel. This will contribute to steel and engineering sectors recovery and enables businesses to leverage off less aggressive steel price increases, improving on their production and profit margins in the current challenging operating environment of high inflationary pressures, volatile exchange rate, COVID-19 and the Russia and Ukraine invasion. There are however some cost push inflationary risks to steel prices emanating from the Russia/Ukraine conflict. There have been substantial increases in the steel input cost basket (coal, zinc, nickel and electricity) which presents this upside risks to domestic prices.

Figure 1: Selected steel selling prices

Palesa Molise Economist | SEIFSA SEIFSA Economics Unit